Understanding What is Considered a Good Equity Multiple in Real Estate Investment

What is a Good Equity Multiple in Real Estate Investment?

Equity multiple is a financial metric that gauge the profitability of real estate investments. It represents how much money an investor can expect to make on each dollar invested. Essentially, the equity multiple measures the total cash returns a property generates compared to the initial equity investment. If you’re considering dipping your toes into real estate, understanding and evaluating this number becomes crucial for making informed investment decisions.

When determining what constitutes a ‘good’ equity multiple, you should consider the context of the investment, including the property type, location, and the period over which the return is generated. A higher equity multiple indicates a more profitable investment. However, this number must be weighed alongside other factors, such as the risk associated with the property and the investment period. Generally, a multiple of 2.0 or higher is often seen as favorable, meaning the investment is expected to double the initial equity invested over its holding period.

Calculating the equity multiple involves dividing the total cash distributions received by the total equity invested in the property. Cash flow plays a significant role in this calculation; consistent revenue from a property would contribute to a higher equity multiple over time. By considering the time value of money, investors can make more precise assessments of potential investment opportunities, examining past performance trends, and making future projections.

Key Takeaways

- Equity multiple reflects total cash returns relative to initial equity investment.

- A ‘good’ equity multiple is contextual, often 2.0 or higher is favorable.

- Calculating equity multiple is essential for evaluating investment profitability.

Understanding Equity Multiple

When you’re looking at the potential success of a real estate investment, two metrics are crucial: Equity Multiple and Internal Rate of Return (IRR). These figures give you insights into the return you might expect on your money.

Definition of Equity Multiple

Equity Multiple is a performance metric used in real estate investments to describe the cash-on-cash return over the life of the investment. It is calculated as the total cash distributions received from an investment, divided by the total equity invested. If you put $100,000 into a property and over time you get $200,000 back, your equity multiple would be 2.0 ($200,000 / $100,000).

Here’s a simple breakdown of the ratio:

- Total Cash Distributions: The sum of all cash flows to the investor.

- Total Equity Invested: The initial amount of equity invested in the property.

Equity Multiple vs IRR

While Equity Multiple gives you a snapshot of the total return on investment, IRR, or Internal Rate of Return, delves into the annual growth rate of that investment.

- Equity Multiple is a straightforward ratio indicating how many times your investment will be returned over the entire period.

- IRR is a more complex calculation that includes the time value of money, providing a yearly rate of return.

Equity Multiple does not account for the time it takes to receive the payback, while IRR reflects both the magnitude and the timing of cash flows. You might have a high Equity Multiple, indicating a doubling of your input funds, but if it takes a very long time to double, the IRR might reveal a less attractive picture.

| Metric | Focuses on |

|---|---|

| Equity Multiple | Total cash return relative to the initial investment |

| IRR | Annual growth rate considering cash flow timing |

By understanding both Equity Multiple and IRR, you can make a more informed decision about your real estate investments.

Determining What is Considered a Good Equity Multiple in Real Estate

In the realm of real estate investments, a ‘good’ equity multiple indicates a lucrative return relative to your initial capital input. Understanding what constitutes a favorable equity multiple is pivotal to evaluating your investment decision’s potential.

Factors Affecting Equity Multiple

Several elements directly influence what may be branded a good equity multiple for your real estate opportunity:

- Investment Duration: Shorter-term investments frequently have lower equity multiples than longer-term investments due to fewer years generating returns.

- Risk Profile: Higher-risk projects may demand a higher equity multiple to compensate for the increased possibility of unpredicted challenges affecting profitability.

- Asset Type and Location: Properties in prime locations or in-demand sectors may warrant a lower equity multiple due to their stability and predictable cash flow.

The interplay of these factors determines the threshold at which an equity multiple transitions from satisfactory to impressive.

Industry Standards for a Good Equity Multiple

Industry standards suggest a minimum benchmark often as the foundation of a good equity multiple. Typically, a multiple:

- Above 1.0x means you’ve received your full investment back plus profits, but the higher the number, the better.

- Around 2.0x over a 5-year investment period is generally considered strong, reflecting a doubling of your investment.

Keep in mind that these standards may fluctuate based on market dynamics and investment types. It’s essential to compare equity multiples within the context of similar investments to gauge true profitability.

Calculating Equity Multiple in Real Estate

In the realm of commercial real estate investment, understanding and calculating the equity multiple is crucial in assessing an investment’s performance. This metric helps you gauge the total monetary return relative to your initial equity stake.

Equity Multiple Formula

To calculate the equity multiple, you need to consider two primary financial figures: the total cash distributions you have received over the investment period and the total equity you’ve invested. The equity multiple is then calculated using the following formula:

Equity Multiple = Total Cash Distributions / Total Equity Invested

- Total Cash Distributions includes the sum of all financial returns you’ve received from the property. This encompasses rental income, profits from property sales, and any other income generated from the investment.

- Total Equity Invested is the initial equity contribution that you put down to acquire the property.

For instance, if you invested $500,000 as the initial investment and over time received $1,250,000 in cash distributions, your equity multiple would be calculated as follows:

Equity Multiple = $1,250,000 / $500,000 = 2.5

This result implies that for every dollar you’ve invested, you’ve received two dollars and fifty cents in return.

Interpreting the Results

Once you’ve calculated the equity multiple, interpreting the figure is fairly straightforward. A higher equity multiple reflects a more favorable total return on your investment. For example:

- An equity multiple of 1.0 means you’ve simply broken even on your investment.

- An equity multiple less than 1.0 indicates a loss, as you’ve received less cash than you originally invested.

- Conversely, an equity multiple greater than 1.0 suggests a profit, earning more than your initial investment.

It is essential to view the equity multiple in conjunction with other financial metrics, like the internal rate of return (IRR), to get a comprehensive view of the investment’s performance over time.

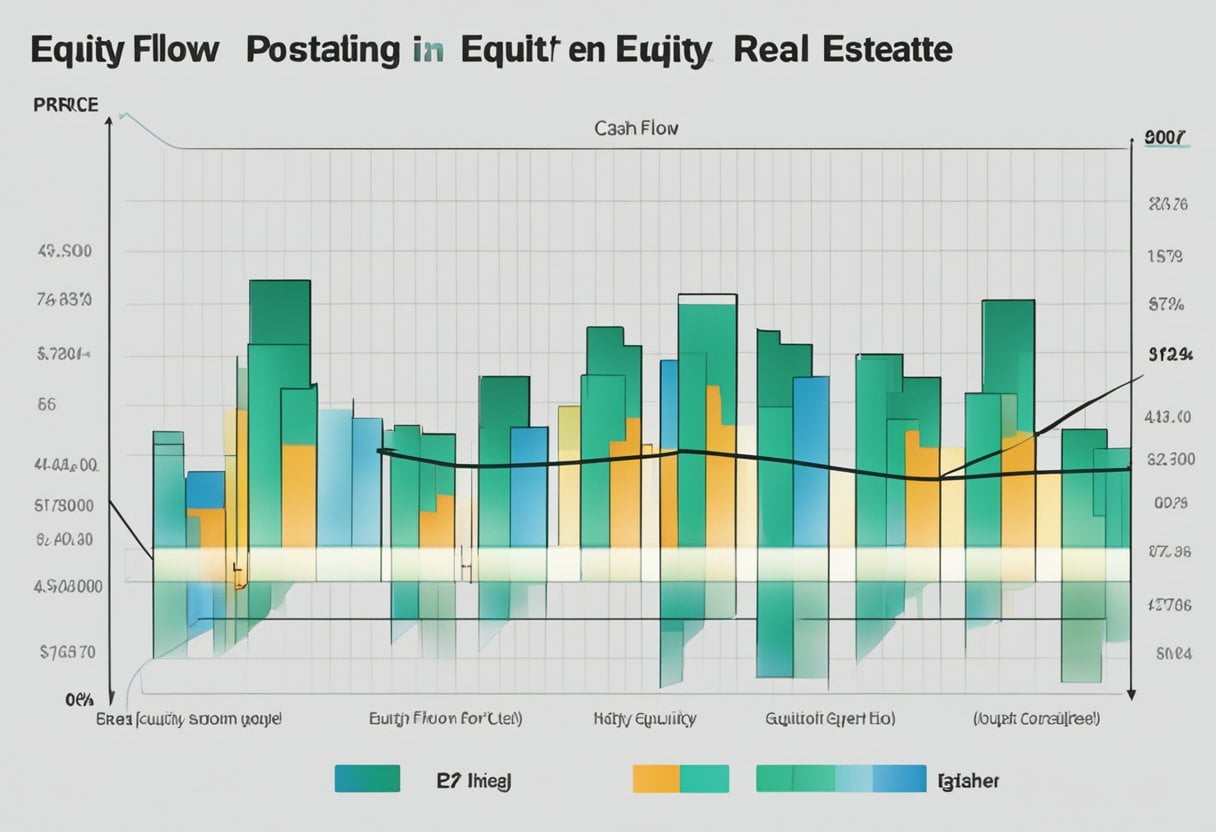

Impact of Cash Flow on Equity Multiple

In real estate investments, the equity multiple directly correlates with the cash flow generated over the duration of the investment. Your understanding of this relationship is critical for gauging the success of an investment.

Understanding Cash Distributions

Cash distributions refer to the cash inflows received by you, the investor, throughout the investment period. To comprehend their impact on the equity multiple, consider these specifics:

- Total Cash Distributions: It is the sum of all cash profits you receive from the property, including operating income, refinancing proceeds, and sales proceeds.

- The formula in use is typically:

Equity Multiple = Total Cash Distributions ÷ Equity Contribution

For example, if you’ve made an initial equity investment of $500,000 and received cash distributions totaling $1,000,000, the equity multiple would be:

[

text{Equity Multiple} = frac{$1,000,000}{$500,000} = 2

]

This outcome indicates that for every dollar of equity you’ve invested, you’ve received two dollars in return.

Cash-on-Cash Return Relation

Cash-on-cash return is a yearly calculation of cash income over the money invested and provides you with an annual rate of return on your investment. Here’s how it differs from and relates to the equity multiple:

- Annual Cash Flow: This is your cash income from the investment per year—after all, expenses have been paid, but before taxes.

- Cash-on-Cash Return: It measures the annual return on the equity you’ve contributed. Calculated by dividing the annual cash flow by your initial equity investment.

Boldly integral to understanding the equity multiple, the cash-on-cash return gives you a glimpse into annual performance, while the equity multiple is your cumulative measure over the investment’s full term. An investment can have a high cash-on-cash return but may not necessarily result in a high equity multiple if the total duration is short or total cash distributions are not substantial.

In sum, when you assess your real estate investment’s performance, scrutinize both the periodic cash-on-cash return and the overall equity multiple for a comprehensive view.

Evaluating Real Estate Investment Opportunities

In the realm of real estate investment, calculating your potential returns and conducting thorough due diligence are cornerstones for making informed decisions.

Comparing Investment Options

When you compare different investment opportunities, one financial metric to consider is the equity multiple. It represents how many times the total equity investment can potentially be returned to you over the life of the investment. For instance, an equity multiple of 1.97 suggests that for every dollar invested, you are expected to receive $1.97 back in return. In commercial real estate, where the stakes are often higher, equity multiples are used as a snapshot indicator of an investment’s performance.

- Assessing Good Value: While there’s no universal “good” equity multiple, a higher value generally reflects better performance. A multiple around 2.0 or higher can be considered robust in many cases, though market conditions and property specifics are crucial modifiers to that benchmark.

- Investment Horizon: Take note that this metric does not account for the time value of money. Hence, similar equity multiples can mean different things depending on the investment timeline—$2 returned over two years is more favorable than over five years.

Importance of Due Diligence

Before committing to any investment, due diligence is essential to validate the underlying assumptions driving projected returns. Here’s how you can apply due diligence to fortify your investment decision:

- Financial Analysis: Scrutinize all financial data, including cash flow projections and the assumptions behind them.

- Market Validation: Research the current market conditions, including supply and demand dynamics, as well as future trends for commercial real estate.

- Physical Inspection: Don’t overlook the value of a physical inspection to uncover potential issues that could impact the property’s performance.

Through diligent analysis, you ensure that you are basing your investment decision on solid, factual grounds, balancing optimism with a clear-eyed view of the realities surrounding the investment.

Role of Time Value of Money in Equity Multiple

The equity multiple in real estate measures the total return on investment, but it’s essential to consider how the time value of money impacts its effectiveness as an investment metric.

Discounted Cash Flows

When you assess an investment, understanding that a dollar today is worth more than a dollar in the future is crucial. This concept is the time value of money. Applying this to real estate investments, future cash flows are discounted to their present value through a process called Discounted Cash Flow (DCF) analysis. This accounts for the decreased purchasing power of money over time, influenced by factors such as inflation and risk. DCF analysis uses a discount rate to calculate the Net Present Value (NPV) of cash flows, often aiding in a more precise valuation of the investment compared to raw figures.

Equity Multiple and Holding Period

The equity multiple directly correlates with the holding period of your investment. A simple calculation of total distributions divided by total equity invested might give you a multiple of 2x, suggesting you’ve doubled your money. However, receiving that 2x over ten years is less valuable, in terms of purchasing power, than receiving it in five years. Therefore, the longer your holding period, the more the time value of money will erode the perceived returns if it’s not accounted for. The equity multiple does not inherently consider the time value of money, which is why it’s vital to view it alongside time-adjusted metrics like IRR to gain a full appreciation of an investment’s performance.

Real Estate Investing Strategies

Investing in real estate requires a well-thought-out strategy, where your goals are to maximize returns and align investment choices with your risk tolerance. It’s about picking the right investment options, considering the investment hold period, and possibly working with a private equity firm to manage your investments efficiently.

Maximizing Equity Multiple

To maximize your equity multiple, you should aim for strategies that increase the potential cash distributions of your real estate investment over time. This could include:

- Value-Add Properties: Investing in properties that require improvements, which you can later sell at a higher price, or charge higher rent, consequently increasing your total cash distribution.

- Optimized Leverage: Carefully leveraging debt to finance acquisitions, which can increase your equity multiple by reducing the initial equity needed while potentially amplifying the investment’s return.

Diversification and Risk Tolerance

Your real estate investing strategy must balance diversification and risk tolerance. Here’s how to approach this:

- Assess Your Risk Profile: Understanding your risk tolerance is crucial. Are you comfortable with high-risk/high-reward projects, or do you prefer slow and steady growth?

- Wide Range of Properties: Diversify your investment options across different property types and geographical locations to minimize risk.

- Investment Hold Periods: Decide on your preferred investment hold period – short, medium, or long term – and select properties accordingly that best utilize capital growth or rental yields over time.

- Private Equity Firms: Consider partnering with a private equity firm if you’re looking for professionals to manage the complexities of real estate investing, as they can provide expertise and access to exclusive deals that might otherwise be unavailable.

Interpreting Past Performance and Projecting Future Returns

Investing in real estate often hinges on understanding historical data to project potential future gains. A good equity multiple, such as 2x, indicates that you might expect to double your initial investment, but it’s crucial to analyze this indicator within the broader context of past performance and projected returns.

Use of Historical Data

You must first review historical data on past real estate investments to gauge how similar properties and markets have performed over time. This will typically involve examining past performance metrics—an annualized rate of return and equity multiples from previous deals. For example, if a property historically returned a 2x equity multiple over a five-year term, this implies previous investors received double their invested capital within that timeframe.

Past Performance Table:

| Year | Equity Multiple Achieved |

|---|---|

| Year 1 | 1.1x |

| Year 2 | 1.3x |

| Year 3 | 1.6x |

| Year 4 | 1.8x |

| Year 5 | 2.0x |

Setting Realistic Expectations

With historical data in hand, you can begin to set realistic expectations for future returns. It’s important to understand that while past performance can guide estimates, it does not guarantee future results. A projected 2x equity multiple might seem compelling, but your projections should also account for a realistic range of outcomes based on potential future cash flows and broader market conditions. It’s essential to consider how variables such as market volatility, interest rates, and property-specific risks could affect the projected returns and adjust your expectations accordingly.

By meticulously interpreting past performance and carefully adjusting for future projections, you are better equipped to make informed real estate investment decisions.

Frequently Asked Questions

Equity multiple is a key metric in gauging the performance of real estate investments. This section provides clear answers to frequently asked questions to help you understand how to assess and interpret this financial indicator.

How do you calculate equity multiple in real estate investments?

To calculate the equity multiple for a real estate investment, divide the total cash distributions received from the investment by the total equity invested. Essentially, this metric tallies the return on investment in multiples of the initial equity.

What signifies a strong equity multiple for a real estate investment?

A strong equity multiple for a real estate investment typically exceeds the benchmark of 1.0, indicating that an investor has made back their initial equity plus additional returns. The higher the equity multiple, the more profitable the investment is considered.

How does equity multiple differ from internal rate of return (IRR) in real estate?

Equity multiple measures the total cash return relative to the equity invested, giving a simple multiple of the original investment. In contrast, IRR calculates the annualized rate of return over the investment’s life, accounting for the time value of money.

What is the significance of a 1.5 equity multiple in property investments?

An equity multiple of 1.5 in property investments means that an investor has received one and a half times their initial equity investment. This benchmark signifies a moderate to strong return, depending on the investment period.

When comparing cash-on-cash return to equity multiple, which one gives a better measure of real estate profitability?

Cash-on-cash return measures the yearly income on an investment compared to the amount of initial equity, offering insight into the investment’s annual income generating capability. Equity multiple provides a cumulative view of total returns over the investment’s lifespan. Both metrics are important, but equity multiple may offer a more comprehensive view of overall profitability.

What benchmarks determine a target equity multiple for successful real estate ventures?

The target equity multiple varies by market conditions, type of investments, risk tolerance, and investment horizon. However, successful real estate ventures often aim for an equity multiple of 2.0 or higher, which would indicate doubling the initial equity investment over the investment’s timeframe.

What role does data visualization play in real estate market research?

Data visualization is a potent tool in real estate market research, transforming complex datasets into understandable graphics. This allows researchers and stakeholders to detect patterns, trends, and outliers at a glance. Using maps, charts, and infographics, professionals can present demographic breakdowns, price evolutions, and comparison studies in a more digestible format. Tools like Tableau or GIS applications are widely used for crafting these visual representations, enabling more strategic decision-making processes.

What are some effective tools for conducting real estate market research?

To perform comprehensive real estate market research, professionals often rely on a variety of instruments. Key tools include Multiple Listing Service (MLS) databases, which provide detailed listings and transaction data for properties. Real estate analytics platforms, such as CoStar or Zillow Research, offer in-depth market insights and trends. For demographic and economic data, the U.S. Census Bureau and Bureau of Labor Statistics are invaluable resources. Additionally, Geographic Information System (GIS) applications enable spatial analysis of market trends and patterns, which can be critical for making informed real estate decisions.

Statistics

- Property data analytics tools have shown to reduce the time spent on market evaluation by 60%, enhancing the efficiency of real estate professionals.

- Approximately 90% of real estate companies use an MLS system to support the sale and purchase of properties.

External Links

- The U.S. Census Bureau provides an extensive reservoir of demographic and economic data vital for real estate market assessments. Visit the U.S. Census Bureau

- Tableau’s powerful visualization tools assist with the interpretation and presentation of real estate market data. Visit Tableau

How To

How to Assess Real Estate Market Liquidity with Analytics Tools

Market liquidity is a critical factor for investment strategy. To assess this, you need tools that analyze sales volume and days on market. Start with an analytics platform that aggregates real estate transaction data and offers customizable reporting features. Study the time on market for properties in your target area and consider volume trends for recent months or years. Look for patterns indicating either a buyer’s or a seller’s market. This analysis helps inform not just the decision on when to buy or sell, but also negotiations on price and terms.