Why Is Diversification Key for Long-Term Success in Real Estate Investing?

Is Diversification Key for Long-Term Success in Real Estate Investing?

Imagine you’ve invested all your funds into a single beachfront property, only to find the market there has crashed due to unforeseen environmental issues. You’re now facing a significant loss. That’s where diversification comes into play.

Diversification is your strategy for freedom from the risks tied to one market or asset type. By spreading your investments across various property sectors and locations, you’re not just putting eggs in different baskets, but you’re also creating multiple streams of potential income.

Diversification helps you ride out market fluctuations, ensuring that a downturn in one area won’t sink your entire portfolio. You’re building a resilient investment foundation that’s more likely to weather economic storms and deliver sustainable growth over time.

Key Takeaways

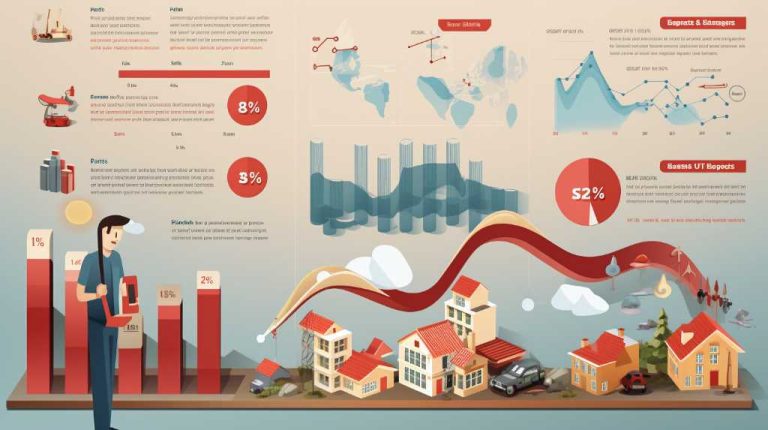

- Diversification in real estate investing reduces risk by spreading investments across different property types and locations.

- It maximizes potential returns by capitalizing on diverse real estate markets and allows for portfolio growth through exposure to various property sectors.

- Diversification enhances stability and resilience by avoiding over-reliance on a single investment and provides income stability through diversified rental income streams.

- It increases opportunities for capital appreciation in different property markets and enhances liquidity by diversifying investments across different property types.

Understanding Risk Management

To effectively manage your investment risks, it’s essential to understand that diversification acts as a safeguard, spreading your exposure across various real estate markets and property types. Building a diversified portfolio isn’t just a strategy—it’s your ticket to maintaining freedom in your financial journey. You don’t want all your eggs in one basket, do you?

By spreading your investments, you reduce risk that can threaten your real estate holdings.

Imagine your investment portfolio as a vessel navigating the volatile seas of the market. Without portfolio diversification, you’re at the mercy of every storm. Diversify your portfolio, and you create a more resilient craft, better able to weather economic downturns. By selecting a mix of properties in different locations and sectors, you’re not only reducing the overall risk but also positioning yourself to capitalize on the growth of multiple markets.

Optimizing Return Potential

While you protect your investments through diversification, you’re also setting the stage to optimize your return potential by tapping into the unique growth opportunities each market and property type offers. Diversification isn’t just about playing defense; it’s a strategic move to maximize returns on your real estate investment portfolio.

By spreading your capital across different investments, you aren’t putting all your eggs in one basket, and you’re giving yourself the freedom to capture gains from a variety of investments.

Think of your portfolio as a tapestry of different asset classes, each with its own set of risks and rewards. By investing in residential, commercial, and industrial properties, as well as exploring options like tax liens or hard money loans, you’re not only mitigating the risks associated with any single investment but also positioning yourself to benefit from the growth potential spread across different real estate sectors.

As a savvy investor, your goal is to strike a balance between safety and growth. Diversification enables you to do just that, turning your real estate portfolio into a robust, long-term investment vehicle capable of weathering market storms and capitalizing on opportunities that deliver freedom and financial prosperity.

Achieving Financial Stability

By diversifying your real estate investments across various markets and property types, you’re not only maximizing your earning potential but also paving the way for greater financial stability. A diversified investment strategy means putting your capital into multiple assets, which reduces risk and enhances your chances for long-term success. This approach is about more than just minimizing risk; it’s about creating a safety net that allows you to pursue your dreams without the fear of financial ruin.

Imagine your portfolio across different asset types as a personal financial fortress—it’s your safeguard against the unpredictable nature of any single market. Real estate investment isn’t just a game of chance; it’s a deliberate method of crafting a resilient financial future. By having investments in various sectors, from residential to commercial, you ensure that a downturn in one area won’t capsize your entire financial ship.

Adopting such investment strategies gives you the freedom to explore new opportunities with confidence. You’ll enjoy the peace of mind that comes from knowing your investments aren’t all riding on the same wave. This diversified approach leads to a more robust portfolio and a more stable financial path, setting the stage for freedom and success in your investing journey.

Expanding Market Exposure

With your portfolio diversified, you’re now set to widen your market exposure, tapping into new regions and asset classes that can offer additional growth opportunities and income streams. By investing in real estate beyond your local scope, you unlock the potential of different markets, each with unique economic drivers. Diversified investments serve as your ticket to freedom from the constraints of a single market’s performance.

Consider property investment not just in residential or commercial spaces but in niche markets like industrial or retail. Like a mutual fund that holds a variety of different stocks, your real estate investment can benefit from the stability offered by multiple types of assets. This approach mitigates risk and can lead to steadier returns.

You don’t have to stop at physical properties. Explore real estate index funds and other financial instruments that allow you to invest in diverse property markets without the need for direct management. This way, you’re not just expanding market exposure; you’re streamlining your investment process.

As you continue to diversify, remember that each new market and asset class carries its own set of risks and rewards. It’s about finding the balance that works for you, setting the stage for securing investment growth.

Securing Investment Growth

You’ll find that a diversified real estate portfolio is a key strategy for securing the growth of your investments over time. By spreading your capital across various properties and markets, you’re not just chasing high returns; you’re building a foundation for personal financial freedom.

Diversified investments in real estate reduce your exposure to market risk, ensuring that a slump in one area won’t capsize your entire investment ship.

Think of your portfolio as a well-conducted orchestra. Each instrument, from the robust index funds to the more speculative financial instruments, plays its part. Together, they create a harmony that can weather the storms of market volatility. In the pursuit of long-term success, this symphony allows you to adapt with agility, sidestepping potential pitfalls that could hinder investment growth.

Remember, real estate isn’t just about riding the waves of the market; it’s about steadying your ship so that, over time, you achieve a robust overall return. Diversification isn’t merely a safety net—it’s a strategic approach to unlocking the doors to lasting financial independence.

Secure your future by investing smartly, and watch as your diversified real estate portfolio paves the way to a life of freedom.

Frequently Asked Questions

What Are the Benefits of Diversification in Real Estate?

You’ll enjoy risk mitigation, market resilience, and a balanced portfolio with diversified real estate. Asset allocation across regions and tenant types ensures investment flexibility, stable revenue streams, and capital preservation for your financial freedom.

What Role Does Diversification Play in Long-Term Investing?

You’re navigating the high seas of finance where diversification steadies your ship against rough waters. It ensures investment resilience, balances your portfolio, and preserves capital amidst unpredictable economic cycles and sector exposure. Embrace the freedom it brings.

Why Is Real Estate a Good Long-Term Investment?

You’ll enjoy property appreciation, steady rental income, and equity buildup. Real estate acts as an inflation hedge with tax advantages, smoothing out market cycles. It’s a tangible asset offering leverage benefits and capital gains.

Why Is Diversification Strategy Important?

You’ll safeguard your investments by mastering diversification. It’s about balancing risks, spreading assets, and embracing geographic and sector variety to thrive through economic cycles and bolster market resilience, ensuring freedom and capital protection.

Conclusion

In the dance of real estate investment, diversification is your rhythm, ensuring you don’t miss a beat when markets sway. By spreading your investments, you’re not just managing risks, you’re courting opportunity.

You’ve built a foundation of financial stability, diversified your market exposure, and set the stage for sustained growth. Remember, diversification isn’t just a strategy; it’s your safeguard against the unpredictable tides of real estate, ensuring your portfolio’s harmony for the long haul.

Keep dancing.

How Does Investing In Real Estate Contribute To Portfolio Diversification?

3 Comments

Comments are closed.