What Are The Essential Strategies to Boost Cash Flow Management in Multifamily Properties?

the Essential Strategies to Boost Cash Flow Management in Multifamily Properties

Navigating the financial waters of multifamily property management, you’ll want to captain your ship with a sharp eye on cash flow management strategies. As you seek the freedom that comes with financial stability, understand that your decisions can either anchor down or set sail to your property’s financial success.

Start by implementing robust financial strategies that align with your goals. Harness the power of management software to streamline rent collection and maintenance requests, ensuring a steady income and controlled expenses.

Regular financial reviews are your compass, helping you stay on course by identifying areas for improvement. Effective tenant management, from thorough screening to fostering community, maximizes occupancy rates and minimizes turnover costs.

Lastly, don’t overlook the importance of reducing operational costs through smart investments in energy efficiency and waste reduction. By adopting these essential strategies, you’ll manage your cash flow as deftly as the tides, securing the freedom you desire.

Implementing Financial Strategies

To effectively boost your multifamily property’s cash flow, you must implement several financial strategies that can optimize your revenue and minimize costs. Start by scrutinizing your building’s operations to identify where you can slash expenses without sacrificing quality or tenant happiness. This approach ensures you’re not penny-wise but pound-foolish, maintaining a desirably high tenant retention rate.

Switching to energy-efficient upgrades not only reduces utility costs but also makes your multifamily property more appealing to eco-conscious renters. By leveraging utility rebates, you’re taking decisive action to keep your operating costs low and your net operating income high. Negotiating with vendors is also a smart move; establish a vendor selection process to secure cost-effective services without compromising on efficiency.

Going the extra mile, consider leasing furnished units. This strategy can increase cash flow by commanding higher rental rates while offering tenants the freedom of a hassle-free move-in. Plus, by providing optional housekeeping services, you not only enhance the tenant experience but also create an additional stream of rental income. Keep in mind that every service you offer is an opportunity to edge towards a more positive cash flow.

Utilizing Management Software

Harnessing property management software is your next vital step in enhancing cash flow for your multifamily property, ensuring no dollar is left untracked or unoptimized. With the right tools, you can smoothly oversee your apartment buildings, liberating you from the clutches of manual paperwork and giving you the power to focus on what truly matters—growing your revenue streams.

This technology isn’t just about convenience; it’s a game changer for Property Managers looking to boost cash flow. Imagine automated rent collection, which not only accelerates your income but also minimizes the hassle of chasing payments. Tenant screening becomes less of a gamble and more of a strategic decision. Maintenance tracking? That’s covered too, so you can address issues before they become costly.

By choosing a software tailored to the unique demands of multifamily real estate, you’re taking a bold step towards financial optimization. It’s not enough to just have the software, though—you’ve got to keep it sharp. Regular updates and thorough staff training are key to harnessing its full potential, cutting down operating expenses, and ultimately, securing your financial freedom.

Embrace this tech-savvy approach and watch your rental property thrive.

Conducting Financial Reviews

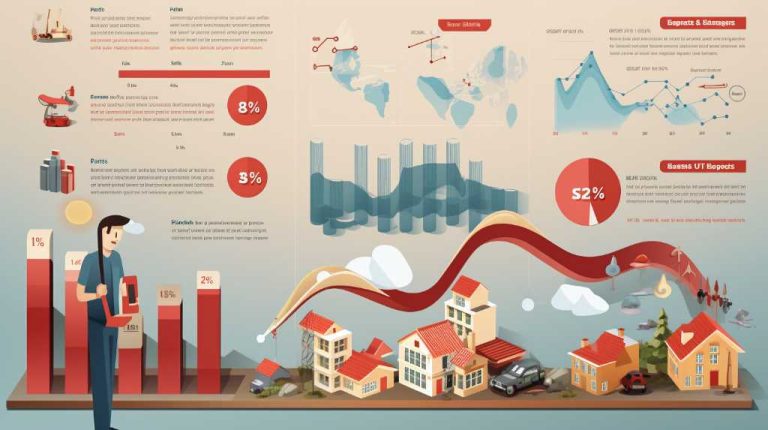

You’ll bolster your multifamily property’s financial health significantly by conducting regular financial reviews to pinpoint inefficiencies and optimize expenditures. These reviews should be thorough and frequent, allowing you to calculate cash flow accurately and make informed decisions. It’s not just about tracking the incoming stream of income; you need to scrutinize what your expenses include. Management fees, market rates, interest rates, and capital expenditures—all these play a crucial role in your property’s financial performance.

Adopt a proactive stance. Don’t wait for surprises; anticipate them by keeping a close eye on the numbers. By understanding the current market rates, you can adjust your rental prices accordingly, ensuring you’re not leaving money on the table. Moreover, by reviewing interest rates, you can refinance at opportune times to improve your cash flow.

Remember, your goal is freedom—financial freedom. That means taking control of your cash flow, reducing unnecessary costs, and maximizing your income potential. Financial reviews give you the clarity you need to steer your multifamily property toward a more profitable and free-flowing future.

Stay vigilant and responsive to the financial pulse of your property, and you’ll navigate the path to financial freedom with confidence.

Effective Tenant Management

Effective tenant management is the cornerstone of sustaining the financial fortitude you’ve cultivated through regular financial reviews, ensuring you keep your cash flow robust and your property thriving. As a property manager, it’s crucial to recognize that your approach to managing tenants can significantly impact your ability to maximize cash flow.

By implementing a tenant retention program that incentivizes residents with lease renewal perks, you’re not just filling a rental unit; you’re fostering a community that values long-term occupancy. This reduces turnover expenses and keeps your monthly rent collection steady. Moreover, by providing top-notch amenities in common areas, you enhance the living experience, justifying rent premiums that contribute to your total income.

Investing in unit renovations and offering appealing upgrades signals to potential and current tenants alike that you value their comfort and satisfaction. It’s a freedom-centric approach that empowers tenants to choose a quality living space, while simultaneously ensuring a competitive edge for your property.

Lastly, a thorough screening process attracts reliable tenants who value their living space as much as you value your cash flow, creating a harmonious balance that benefits everyone. Effective tenant management, therefore, isn’t just about filling vacancies; it’s about creating a stable, lucrative habitat for all.

Reducing Operational Costs

To significantly trim your multifamily property’s operational costs, you need to scrutinize every expense and seek ways to reduce them without sacrificing quality or tenant satisfaction. By implementing utility rebates and energy-efficient upgrades, not only do you cut costs, but you also contribute to a greener environment, which can be a selling point for potential tenants valuing sustainability.

Developing a preventative maintenance program is crucial in avoiding negative cash flow caused by unexpected, expensive repairs. Regular upkeep helps save money in the long run and ensures your buildings’ operations run smoothly.

Similarly, establishing a thorough vendor selection process can mean the difference between overpaying for mediocre services and finding cost-effective solutions that don’t compromise on excellence.

Consider the power of competition; bidding out the property management role can incentivize companies to offer you better value, helping to enhance security and reducing interest rates on services, thus maximizing cash flow.

As a savvy commercial real estate investor, tapping into the expertise of seasoned companies like Farbman Group could provide you with the insights needed to boost your bottom line.

Frequently Asked Questions

How Can I Increase My Cash Flow From Rental Property?

To increase your rental cash flow, optimize rent, audit expenses, and focus on tenant retention. Adjust lease lengths, explore ancillary income, consider refinancing, invest in energy efficiency, implement preventative maintenance, and streamline payment policies for operational efficiency.

Which Strategy Is a Way to Improve Cash Flow?

Navigating cash flow improvement is like steering a ship through stormy seas. Tighten your sails with tenant screening, conduct expense audits, and harness energy savings. Online payments and vendor negotiations can also chart a smoother course.

How Do You Maximize Real Estate Cash Flow?

To maximize real estate cash flow, focus on rent optimization, rigorous expense auditing, and boosting tenant retention. Refinance to cut costs, invest in energy efficiency, and explore ancillary income opportunities. Prioritize preventive maintenance and reduce vacancies.

What Are Some Ways of Increasing Your Cash Inflows?

Unlock your cash flow like a pro by auditing expenses, optimizing rents, slashing vacancies, harnessing ancillary revenue, boosting energy efficiency, tightening payment policies, screening tenants wisely, crafting smart leases, exploring refinancing, and forecasting finances.

Conclusion

In conclusion, steer your property’s cash flow in the right direction like a seasoned captain navigating the high seas.

Embrace savvy financial strategies, harness cutting-edge management software, and conduct thorough financial reviews.

Manage your tenants effectively and slash operational costs to keep your financial ship buoyant.

Remember, in the bustling ocean of multifamily properties, it’s not just about staying afloat—it’s about sailing towards a horizon of prosperity.

How Can Effective Multifamily Cash Flow Management Boost Your Profits?

2 Comments

Comments are closed.