7 Reliable Economic Indicators to Navigate Real Estate Cycles

What are the reliable economic indicators?

As they say, knowledge is power, and in the realm of real estate, that power gives you the freedom to make your best move. Understanding the ebb and flow of the market is critical, and you’ve got to keep your finger on the pulse of the economy to do just that.

These seven reliable economic indicators are your compass through the ever-shifting landscape of real estate cycles. You’ll want to watch Gross Domestic Product (GDP) trends, scrutinize employment statistics, and track interest rate movements.

Housing starts data will show you where construction is heating up, while inventory levels indicate if the market’s tight or flush with options. Home price indices, like the Case-Shiller Index, and consumer confidence reports will round out your toolkit, providing insight into where the market’s headed.

With these in hand, you’re set to navigate the waves of real estate with confidence.

Gross Domestic Product (GDP)

https://www.youtube.com/embed/7ldp1jBrjns

As you assess the real estate market, it’s vital to understand that GDP reflects the total economic output, which directly influences property demand and investment trends. The health of the real estate sector often mirrors the overall economic growth. When GDP growth is robust, you’ll likely see a surge in economic activity that fuels demand for housing and commercial spaces. The market may also move depending on how any one quarterly real GDP measure compares to prior quarters, and how the actual real GDP compares to economists’ expectations as well as any revisions to the short term or long term forecasts of real GDP, taking into account price changes. The U.S. Department of Commerce’s Bureau of Economic Analysis is responsible for reporting both standard and real GDP, with the final figure being published after two preliminary estimates. Real GDP, which includes government spending, is considered a key indicator of economic health as it measures the entirety of the U.S. economy.

Tracking economic indicators, particularly GDP, equips you with insight into the demand for real estate. It’s more than numbers; it’s a signal to tailor your strategies, ensuring you’re ahead of the game. Don’t just ride the real estate cycles—master them. As GDP, an important coincident indicator of economic health and home sales, expands, so does the opportunity for savvy real estate investment in the global economy. On the flip side, when GDP falters, brace yourself. It’s a sign to tighten your harness and perhaps look for alternative investment avenues.

Understand the relationship between the real estate and broader economic landscapes to navigate the market with confidence. With this knowledge, you’re not just following trends; you’re anticipating them. So, keep a close eye on GDP growth rates. They’re your roadmap to freedom in the fluctuating world of real estate.

Employment Statistics

You can gauge the health of the real estate market by scrutinizing job growth and unemployment rate trends.

If more people are working, there’s typically a higher demand for housing, as steady jobs mean potential buyers are more confident and financially secure.

Conversely, rising unemployment often signals a downturn in the market, with fewer individuals able to afford home purchases.

Job Growth Impact

Examining the nation’s employment statistics reveals how job growth can bolster your real estate investment decisions. As you navigate the intricacies of the real estate cycle, it’s essential to understand that employment and job growth are pivotal economic factors that can significantly impact the securities markets. They directly influence the labor market’s dynamics, affecting both the housing demand and real estate prices. Understanding the number of jobs created each month and the national unemployment rate, as reported by government agencies such as the Bureau of Labor Statistics, can provide valuable insights into the strength of the economy and the potential for rising inflation. Additionally, paying attention to the percentage figure of the unemployment rate can give a more accurate understanding of the job market’s health and its potential impact on the real estate market.

A low unemployment rate typically signifies a robust economy, empowering more people to invest in the real estate sector. Conversely, high unemployment can dampen the housing market, as fewer individuals have the means to purchase homes.

Always keep an eye on these trends; they’re your compass to freedom through informed investments. Remember, a thriving job market often leads to a vibrant housing market, making it a prime time to invest in real estate.

Unemployment Rate Trends

Understanding unemployment rate trends is crucial for gauging the health of the real estate market and making savvy investment choices. As you cherish your freedom, it’s essential to recognize how the job market serves as a key economic indicator.

High employment levels typically boost housing demand, propelling the real estate cycle forward. Conversely, rising unemployment can signal trouble, hinting at a potential downturn in economic health and a cooling real estate market.

Keep a close eye on these trends—they influence interest rates and mortgage rates, directly affecting your power to secure financing and invest confidently. By staying informed, you’re better equipped to navigate the real estate landscape, ensuring your decisions aren’t only free but also fortified by insight.

Interest Rate Trends

You need to keep a close eye on interest rate trends as they directly affect your mortgage payments and the overall cost of borrowing.

As rates shift, so does the allure of real estate investment, with your potential returns swinging in tandem.

Understanding how fluctuations in borrowing costs impact the market is key to making informed decisions in real estate.

Mortgage Rate Impact

As you consider your next real estate investment, it’s essential to recognize that mortgage rates, often determined by broader interest rate trends, can significantly influence your potential return. When interest rates rise, you’ll see a cooling effect on housing demand – fewer people can afford to buy, and property prices may stabilize or even dip due to decisions made by the Federal Open Market Committee (FOMC).

Conversely, low interest rates often heat up the real estate markets, boosting housing affordability and prompting new construction. You’re aiming for the sweet spot where your investment properties yield robust returns without being hamstrung by prohibitive mortgage rates.

Keep a keen eye on these mortgage rate impacts; they’re the rudder steering the ship of your real estate ventures toward prosperous shores or choppy waters.

Investment Attractiveness Shift

Consistently monitoring interest rate trends is crucial, as they frequently dictate the shifting allure of real estate investments for you as an investor. When interest rates dip, it’s your cue; the property market becomes more enticing, boosting demand. Cheaper loans mean you’ve got the freedom to seize opportunities and expand your portfolio. Keep an eye on the federal funds rate and Wall Street’s reaction to it, as it directly impacts interest rates and can signal shifts in investment attractiveness. Additionally, paying attention to the Federal Reserve’s interest rate announcements and meeting minutes can provide valuable insights into potential changes in the market.

Conversely, as rates climb, the cost of borrowing spikes, potentially cooling off the market. You’ll see a visible impact on the real estate cycle—construction activity may slow, vacancy rates could rise, and the supply of real estate might outpace demand.

As an investor, you’re in the game for the long haul. Use interest rates as your economic compass—they’re not just numbers; they’re signals, guiding your strategic moves through the ever-changing landscape of the property market.

Borrowing Cost Fluctuations

Understanding the volatility of borrowing costs is essential for navigating the real estate market’s ups and downs. As central banks tweak interest rates, they’re not just adjusting numbers—they’re steering the economic cycle that directly affects your freedom to invest and prosper.

With lower interest rates, the cost to borrow drops, making it more tempting to snag new property or kick off new construction. This can lead to a bustling real estate market, with more accessible financing fueling demand and potentially inflating prices.

Conversely, when central banks hike rates, your wallet feels the pinch. Higher borrowing costs can choke demand, causing a slowdown that might make you think twice before diving into an investment.

Stay sharp—these shifts can dictate your real estate market moves.

Housing Starts Data

Your assessment of the real estate market’s trajectory can be sharpened by examining the housing starts data, which reflects the number of new residential construction projects initiated within a given month. This metric is vital as it represents the first stage in the Stages of the Real Estate Cycle.

When you see a rise in the number of new construction projects, it often signals an expansion phase in the market, suggesting that Home Builders are confident and demand for new homes may be increasing.

By tracking the construction of new homes, you can anticipate shifts in housing prices and gauge the economic health of the sector. A surge in housing starts indicates that builders expect buyers to step forward, ready to invest in a New Home. Conversely, a drop in these numbers might signal caution, hinting at a possible slowdown. Additionally, the Department of Commerce’s monthly report on new residential sales, provided by the National Association of Realtors, offers valuable information on home sales, giving insight into consumer sentiment and the overall state of the housing market.

Remember, housing starts data isn’t just about quantity; it’s a snapshot of economic momentum. Use this information to make informed decisions, whether you’re an investor eyeing the market’s pulse or a homebuyer seeking the best time to enter the fray.

Stay ahead of the curve by keeping a close eye on the ebb and flow of new construction projects – your freedom to choose wisely in real estate depends on it.

Inventory Levels

Assessing inventory levels, you’ll gain a clearer picture of the real estate market’s current supply and demand dynamics. Inventory levels are a critical signpost guiding your freedom to make savvy decisions, whether you’re eyeing residential real estate or commercial properties. A low inventory suggests a seller’s market, where competition for each home is fierce, often driving up prices. Conversely, high inventory can indicate a buyer’s market, offering you more choices and bargaining power.

When inventory levels rise, it’s a hint that you might snag a property at a more reasonable rate, especially if new construction is adding to the supply. For those looking to invest, high vacancy rates in commercial real estate signal opportunities to purchase at lower prices, with the potential for significant rental income when the market rebounds.

Keep an eye on the real estate market trends; changes in inventory levels can forewarn of economic downturns. A sudden spike in inventory might reflect a cooling market, while a drop could suggest a heating one. By tracking these shifts, you’ll position yourself to act when the time’s right, ensuring your investments are timed to harness the cycle’s ebb and flow for maximum freedom and financial gain. Additionally, monitoring the stock market and stock prices can also provide valuable insights into the overall state of the economy and help investors make informed decisions about their real estate investments.

Home Price Indices

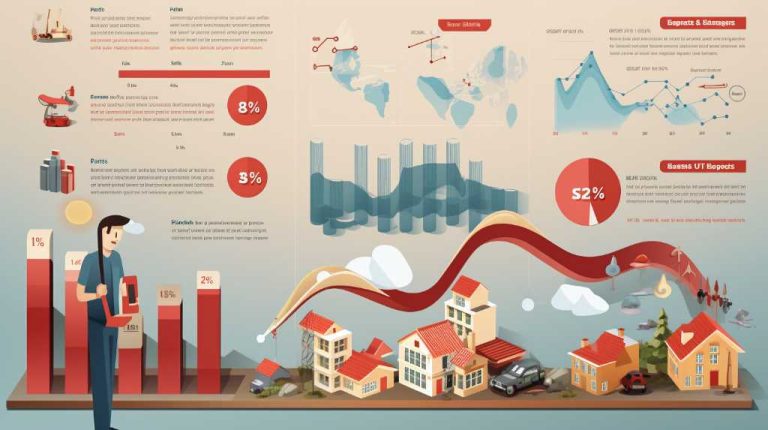

As you monitor inventory levels, you’ll also want to pay close attention to home price indices like the Case-Shiller Index and HPI, as well as the Dow Jones Industrial Average and S&P 500, which are key indicators of current housing market values and trends. These indices, along with the Consumer Price Index (CPI) and the first inflation measure, the Producer Price Index (PPI), give you the freedom to make informed decisions, whether you’re buying, selling, or developing real estate investment strategies for urban consumers.

During periods when new construction is booming and interest in the market is high, home price indices can provide early signals of a recovery phase in the real estate cycle. Prices start to rise, reflecting increased demand for new homes and the overall health of the economy. By keeping an eye on these indices, you’ll capture the pulse of the market, spotting when the tide is turning.

Remember, real estate isn’t just about location; it’s also about timing. The Case-Shiller Index and HPI help you gauge when to enter or exit the market for maximum benefit. They’re the compass that guides you through the complex terrain of property investment, ensuring you’re never lost in the maze of market fluctuations.

Use these indices to your advantage, and you’ll navigate the real estate cycle with the confidence of a seasoned pro.

Consumer Confidence Reports

You’ll often find that consumer confidence reports, such as those released by the Conference Board, serve as a critical barometer for gauging the vitality of the real estate market. These reports aren’t just numbers on a page; they’re a pulse check on how optimistic people feel about the economy. When confidence is high, you’re likely to see a surge in real estate cycles, as people are more inclined to invest in homes and properties. It’s about freedom—the freedom to pursue estate investments without the weight of economic uncertainty. Another reliable economic indicator is the Beige Book, released by the Federal Reserve eight times per year. This report outlines the nation’s economic conditions and can be a useful resource for investors, economists, and analysts. Additionally, these reports typically report on activity in the previous month, providing valuable insights and comparisons for investors. The U.S. Conference Board’s Leading Economic Index is also a key leading indicator to consider, as it uses a variety of economic indicators to predict the direction of the economy.

These economic indicators are reliable tools to help you navigate through the complexities of market trends. Whether you’re an investor looking to bolster your portfolio or a policymaker crafting legislation, understanding consumer confidence can lead to informed decisions that align with an optimistic economic outlook.

Remember, investor confidence often mirrors consumer sentiment. If people are hesitant or pessimistic, it can signal a downturn in the real estate market. To stay ahead, keep a close eye on these reports, including consumer spending data and the retail sales report. They can provide you with the foresight to adjust your strategies, ensuring your investments remain robust even when the tides of the economy shift.

Consumer confidence reports are more than a metric; they’re a compass for your financial freedom in the world of real estate.

Frequently Asked Questions

Which Economic Indicator Should Be Monitored to Analyze the Residential Real Estate Market?

To analyze the residential real estate market, you should monitor housing starts, building permits, mortgage rates, employment trends, consumer confidence, inflation rates, homeownership rates, credit availability, inventory levels, and interest policy.

What Are the Economic Components of the Real Estate Cycle?

You’ll track interest rates, construction activity, and job growth to gauge market health. Monitor consumer confidence, rental yields, inventory levels, land values, government policies, market sentiment, and credit availability for informed decisions.

What Are the Indicators of a Recession in Real Estate?

You’ll notice a real estate recession by dips in housing starts, rising foreclosure rates, and mortgage defaults. Interest fluctuations, soaring construction costs, and bloated inventory levels also warn you to brace for impact.

What Are the Three Most Important Factors in Real Estate Investments?

You’ll find that location trends, market liquidity, and investment yield are crucial in real estate. Keep an eye on rental demand, property taxes, interest rates, demographic shifts, building permits, and zoning changes. Freedom awaits!

Conclusion

As a captain relies on stars to sail the vast ocean, you can navigate the real estate seas using these economic constellations.

Watch the GDP’s glow, heed the employment wind, and set your course by interest rate currents.

Housing starts and inventory levels are your compass and map, while home price indices and consumer confidence whisper tales of distant market shores.

With these seven stars to guide you, chart a course to prosperous lands and safe harbors in your property voyage.

You Might Also Like…

9 Pivotal Economic Indicators To Watch: Unlocking Real Estate Cycles

10 Essential Economic Indicators Decoded: Real Estate Cycles

One Comment

Comments are closed.